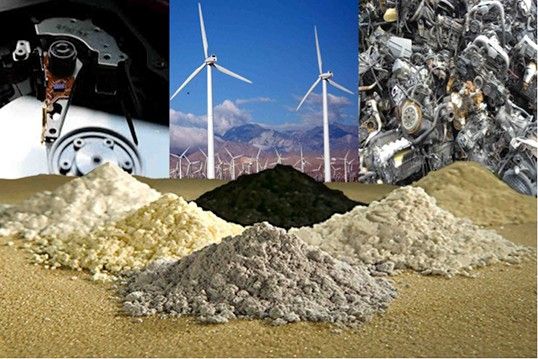

Rare earth elements, a group of 17 minerals critical for modern technology, are increasingly drawing attention in global trade and industry. Widely used in electric vehicles, wind turbines, and advanced electronics, these minerals are reportedly becoming central to strategies aimed at balancing economic growth with supply chain security.

Historical records indicate that minerals such as tin and tungsten once played a defining role in Southeast Asian economies, shaping trade and industrial growth. Analysts reportedly observe that today’s focus on rare earths reflects a continuation of how strategic resources can influence both markets and long-term policy planning.

China’s Dominance and Global Adjustments

China continues to be the leading player in this sector, reportedly responsible for around 60% of rare earth mining, 85% of processing, and over 90% of permanent magnet production. Export restrictions introduced earlier this year have apparently caused ripple effects across industries dependent on these materials, from renewable energy to electric mobility.

The United States has reportedly taken steps to strengthen domestic capacity. A recent agreement between the Department of Defense and MP Materials sets a floor price for neodymium-praseodymium (NdPr), a move seen as part of efforts to establish a mine-to-magnet supply chain independent of China.

Japan and India Diversify Supply Chains

Japan has made progress in reducing reliance on Chinese supplies, with imports from China reportedly falling to about 60%. The country is aiming to lower that figure further by the end of 2025, reflecting broader efforts to diversify sourcing and build resilience.

India is also pursuing diversification. Companies such as Ather Energy have reportedly adapted by shifting toward light rare earths and sourcing from multiple countries. At the same time, the government is engaging with partners, including Australia, Zambia, and South American nations, to secure critical mineral supplies for long-term industrial needs.

Shifting Ground in the Rare Earths Market

Observers suggest that the rare earths market is entering a period of transition. While China remains the dominant supplier, initiatives in the U.S., Japan, and India reportedly highlight a broader push to reduce vulnerabilities and create more balanced supply chains. The coming years will likely reveal how these strategies shape both global trade and the industries that depend on these essential materials.