The semiconductor and critical minerals sectors are emerging as focal points of global industrial strategy. In recent days, multiple developments, from legal disputes and tariff actions to financial reforms and international proposals, have underlined a shifting supply chain landscape.

Semiconductor Market Under Strain

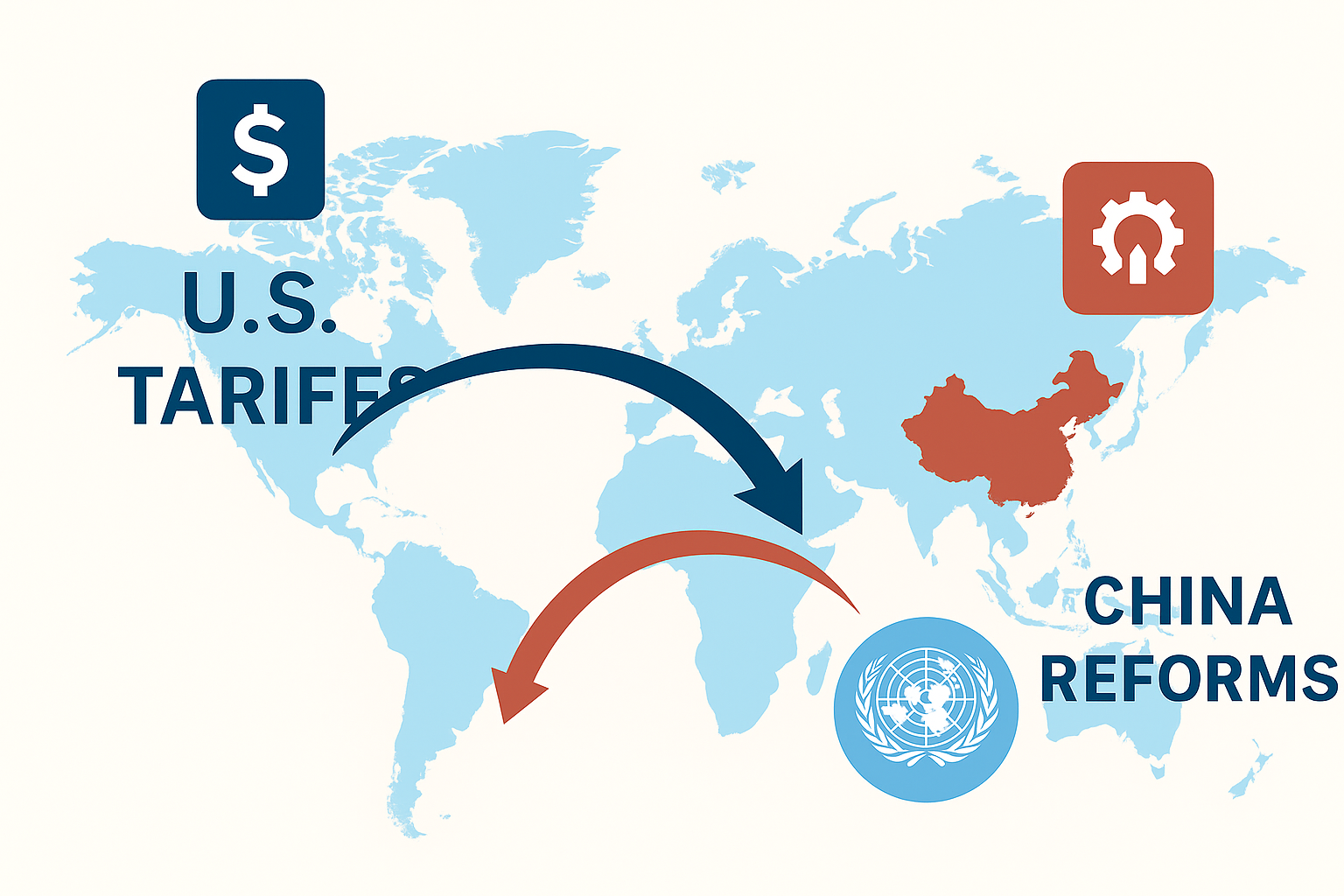

Taiwan Semiconductor Manufacturing Co. (TSMC) has launched legal action over alleged intellectual property theft, underscoring persistent risks in the global semiconductor ecosystem. Meanwhile, the United States has introduced tariffs of up to 100% on select semiconductor imports, though exemptions are planned for companies with domestic investment commitments.

The tariff measures are expected to affect supply relationships across Asia, with South Korea, Japan, and Taiwan identified among the most exposed exporters. Industry reports note that U.S. policy is also linked to efforts to accelerate domestic chip production under the CHIPS and Science Act, with new fabrication plants under development in Arizona, Texas, and Ohio.

China’s Industrial Finance Push

China has issued new guidelines to accelerate lending for critical technologies, establishing “green channels” to support high-end manufacturing and clean-energy projects. The measures are part of Beijing’s broader initiative to foster intelligent, efficient, and sustainable industrial growth by 2027.

Industrial lending is expected to play a critical role. GVR analysis indicates the global industrial lending market is poised for steady growth of USD through 2032, driven by capital requirements for advanced manufacturing, infrastructure upgrades, and supply chain diversification.

UN Minerals Trust Proposal

On the resources front, the United Nations University has advanced a proposal for a Global Minerals Trust aimed at stabilizing clean-energy and digital supply chains. The initiative would pool critical commodities, prioritize recycling, and strengthen resilience against disruptions caused by resource nationalism and trade frictions.

Grand View Research projects that demand for critical minerals, including lithium, cobalt, and rare earth elements, will expand sharply this decade, with clean-energy technologies accounting for over 50% of total demand growth. The trust proposal seeks to manage these pressures while embedding social and environmental safeguards.

Strategic Implications

The convergence of legal disputes, tariff measures, industrial finance reforms, and cooperative resource proposals is reshaping expectations for semiconductors, mining, and advanced manufacturing.

- Risks: Supply chain disruptions, policy misalignment, and trade frictions.

- Opportunities: Reshoring initiatives, diversification of sourcing, and investment in sustainable production systems.

Key Takeaways for Global Supply Chains

- Semiconductor tariffs and legal disputes are reshaping trade and investment flows.

- Industrial finance measures in China are set to increase access to capital for advanced technologies.

- Proposals for cooperative resource frameworks indicate efforts to reduce volatility in critical minerals markets.

- GVR data highlights significant growth trajectories across semiconductors, industrial lending, and minerals, underscoring the scale of upcoming shifts.