Road safety is a critical global public-health concern, with the World Health Organization reporting an alarming 1.19 million road crash fatalities each year. This persistent crisis drives governments and industry leaders toward active accident-prevention solutions, making the ADAS Market a focal point for innovation. Advanced Driver Assistance Systems (ADAS), such as automatic emergency braking and lane departure warning, are seen as practical and scalable technologies to address this challenge, fundamentally reshaping modern vehicle design.

The staggering death toll underscores the necessity of rapidly adopting these safety technologies, which have evolved from mere convenience features to become strategic requirements for automakers. Consumers now have a vital expectation for vehicles that genuinely enhance safety. This shift in perception and policy has cemented the role of ADAS as a central element in automotive design and technology development.

Market forecasts strongly support this momentum, with the global ADAS Market projected to reach substantial revenues of USD 66 billion by 2030, growing at a robust CAGR of 12.2%, according to Grand View Research, Inc. This expected double-digit growth confirms the vital role that Advanced Driver Assistance Systems will play in achieving significant reductions in global road crash figures.

What exactly is ADAS?

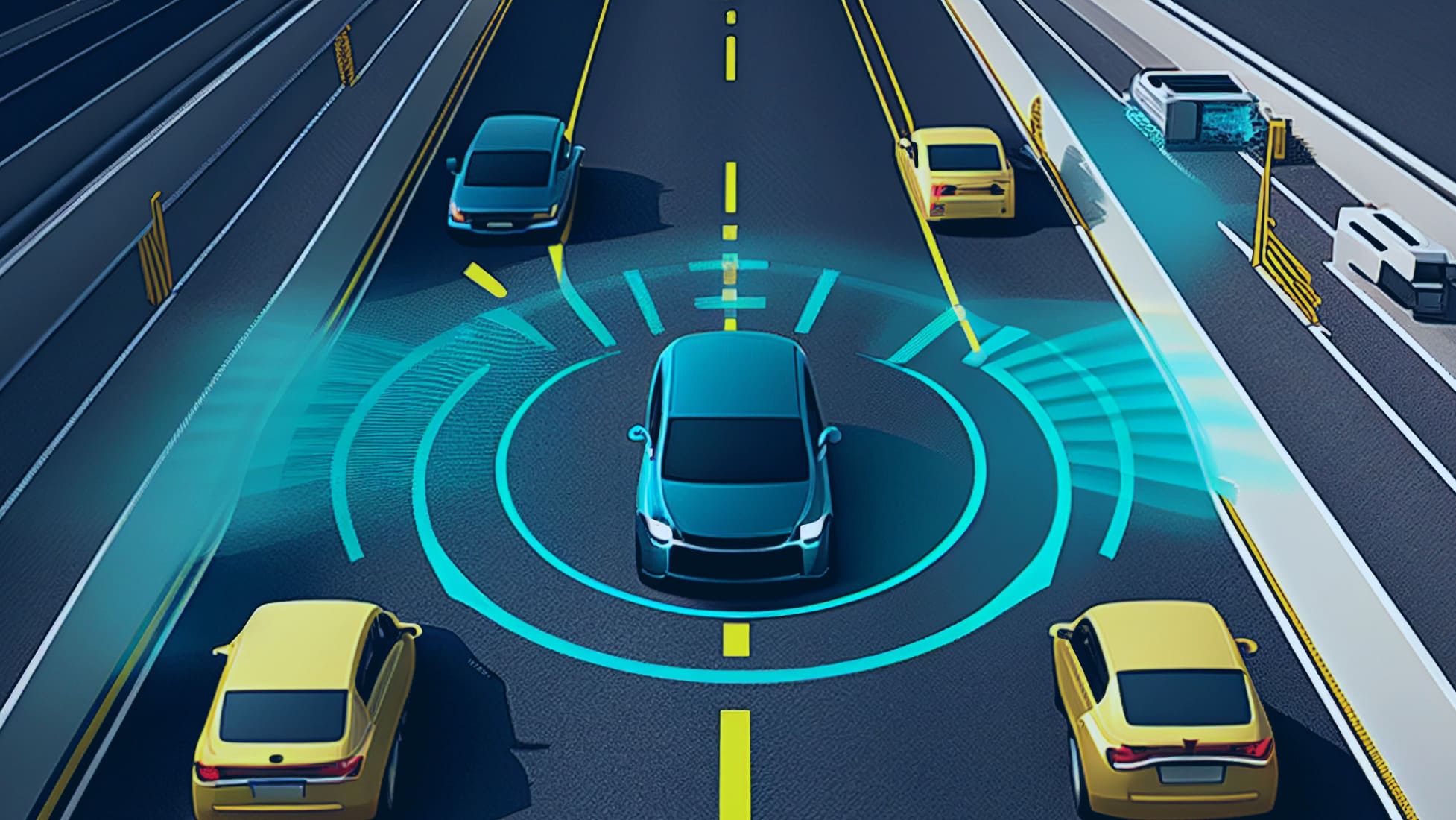

ADAS stands for Advanced Driver Assistance Systems, a collection of technologies designed to support drivers, reduce accidents, and make driving more comfortable. At its core, ADAS combines sensors (such as radar, cameras, LiDAR, and ultrasonic) with software algorithms that interpret the environment and assist or intervene when necessary. Think of ADAS as a bridge between traditional driving and autonomous vehicles. It doesn’t replace the driver but enhances their awareness and reaction time.

Why the ADAS Market Is Strengthening

Several factors are propelling the growth of the ADAS industry with uncommon consistency. The first is regulation. Governments in Europe, North America, and parts of Asia continue to introduce safety mandates that require specific ADAS functions to be built into new vehicles. These rules directly influence automotive engineering cycles, as manufacturers must integrate compliant systems into every mainstream model rather than limiting them to premium lines.

The second driver is the accelerating shift toward electric vehicles (EVs). EVs rely on software-centric architectures and sensor-rich platforms, which facilitate the integration of advanced driver assistance features. Companies such as Tesla, BYD, and Hyundai are deeply embedding ADAS into their EV platforms, while technology suppliers like Mobileye, Bosch, Continental, NVIDIA, and Magna International provide core components ranging from camera-based perception systems to high-performance ADAS control units.

How ADAS Technologies Work and Why They Deliver Measurable Benefits

ADAS systems combine sensors such as radar, cameras, ultrasonic units, and sometimes LiDAR with algorithms that interpret road environments in real time. What makes these systems effective is their ability to detect hazards faster than human reflexes. Machine learning and computer vision enhance ADAS reliability by accurately identifying objects and predicting the behavior of surrounding vehicles. This is especially important in poor visibility, heavy traffic, or complex driving conditions, and their effectiveness is a key driver for the robust growth seen in the ADAS market.

The benefits are not theoretical. Waymo, which operates autonomous ride-hailing vehicles using technology derived from ADAS principles, documented 0.6 injury-reported incidents per million miles, compared to 2.8 per million miles in human-driven benchmarks across comparable driving environments., such as radar, cameras, ultrasonic units, and sometimes LiDAR, with algorithms that interpret road environments in real-time

Consumer Behavior and Industry Response in ADAS Market

Today’s buyers expect vehicles to actively help prevent collisions rather than merely withstand them. This expectation is leading to the broader adoption of features such as adaptive cruise control, blind-spot detection, and lane-keeping assist. These are now standard on many mid-range vehicles that were previously equipped with only basic safety features.

Organizations also shape market demand, which directly impacts the ADAS Market. The Insurance Institute for Highway Safety (IIHS) evaluates and ranks the effectiveness of ADAS, influencing consumer decisions and prompting automakers to refine the reliability of these systems. Meanwhile, suppliers like Autoliv focus on integrating ADAS with next-generation restraint systems, while companies such as ZF and Aptiv continue to develop modular ADAS solutions that enable manufacturers to scale up their safety offerings over time.

Points of Caution for the Road Ahead

The cost of high-precision sensors, especially LiDAR, continues to limit their adoption in lower-priced vehicles. This cost barrier presents a major challenge to the widespread expansion of the ADAS Market. Although camera-based systems are more affordable, they can be affected by lighting and inclement weather. Meanwhile, for lane-keeping and traffic-sign recognition to work reliably, roads must have clear markings and standardized signage. Therefore, inconsistent infrastructure in certain regions can undermine ADAS performance and erode consumer trust.

Furthermore, when drivers misunderstand the limits of ADAS, they may place excessive confidence in automation, which creates new risks that must be addressed for sustained growth in the ADAS industry. The ongoing scrutiny of systems like Tesla’s Autopilot by agencies such as the NHTSA illustrates the critical importance of manufacturers clearly communicating their capabilities and limitations to ensure safe and effective system adoption.

The Future in Motion

The next chapter of the ADAS market will be shaped by improvements in sensor fusion, where data from multiple sensor types is combined to produce highly reliable environmental awareness. Over-the-air (OTA) software updates will enable automakers to continuously refine ADAS functions, much like smartphone software updates, allowing vehicles to improve even after purchase continually.

As global safety regulations become more stringent and consumers expect vehicles that can actively protect them, ADAS will move deeper into the core of vehicle design. In the long term, these systems will serve as stepping stones toward higher levels of automation, helping reduce the global burden of injuries and fatalities that remain far too common on the roads.